In the dwindling weeks of Donald Trump’s presidency, the Justice Department announced that it had reached a settlement with Boeing to resolve a years-long criminal investigation after two 737 Max jetliners crashed and killed 346 people. The headlines predictably focused on the top-line figure that the government had advertised — a $2.5 billion payment from the company — but this was about as accurate as a Trump University marketing flyer. In fact, this may have been one of the most unusual and ill-conceived corporate criminal settlements in American history.

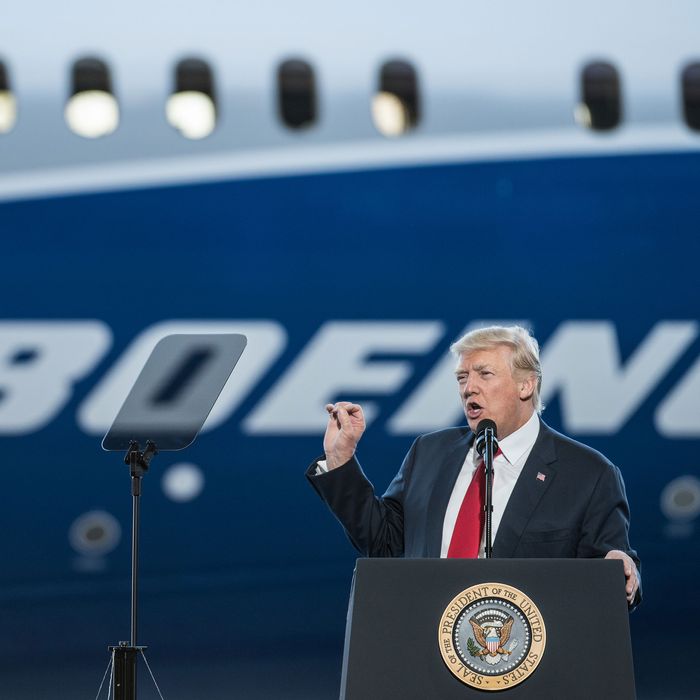

Until last year, I worked in the Justice Department office that conducted the investigation, the Market Integrity and Major Frauds Unit, and I know several people on the team (though I had no involvement in the investigation). DOJ under Trump was unprecedentedly lax in its efforts to fight financial fraud and white-collar crime — which have reached all-time highs while criminal prosecutions in the area have hit all-time lows, and which have also included high-level meddling by political appointees in major corporate investigations. Trump’s Justice Department made a preelection push to persuade credulous observers that it was finally cracking down on corporate crime by hastily completing an antitrust case against Google, announcing a settlement with Purdue Pharma over its marketing of the drug OxyContin, and finalizing a deal with Goldman Sachs to resolve a lengthy foreign bribery investigation — but even that effort was decidedly less impressive than it appeared, and it made the announcement of the Boeing deal, just days before the end of the Trump administration, even more conspicuous.

The Boeing settlement was based on conduct by two relatively low-level employees who, according to the government’s recitation of the facts, provided “incomplete and inaccurate” information about the 737 Max’s flight-control system to the Federal Aviation Administration. The government alleged — and Boeing admitted — that their purpose was to ensure that the company did not have to impose more intensive and costly training requirements on pilots, but the agreement stops short of saying that the employees’ deception caused either crash — or even that the FAA would have done anything differently if the pilots had disclosed the information. (Those two Boeing employees have not been criminally charged.)

The government probably appreciated that the public would not take this well, which may have been the impetus behind the $2.5 billion settlement. Nearly two-thirds of it (about $1.8 billion) is money that Boeing will pay to airlines for costs that they incurred as a result of the grounding of the planes, but the company had set that money aside for them long ago, so really, the government is taking credit for something that was already going to happen. Another $500 million is for a victim-compensation fund. Boeing agreed that the fund would not “preclude” victims’ families from bringing legal claims — some have already settled, while many have outstanding cases — but judges and juries also follow the news, and it is hard to see them ignoring the fund, as Boeing surely knows. In fact, less than one-tenth of it ($243.6 million) is an actual fine.

In theory, there is a complicated set of federal guidelines for setting fines, but suffice to say that the Justice Department’s calculation, which is contained in the agreement, adopted virtually the most lenient interpretation of those guidelines possible. The $234.6 million fine, according to the department, represents “Boeing’s cost-savings” from the two employees’ misconduct. Essentially, the government just required the company to give up its ill-gotten gains. A precise analogue is hard to come by, but a useful comparison is the government’s 2012 settlement with BP following the Gulf Coast oil spill — a deal that required the company to pay the federal government $4 billion in criminal fines and penalties (followed later by a roughly $15 billion payment to settle civil claims).That means that Boeing’s payment of $243.6 million is essentially the only real “new” money that Boeing will pay.

This may still seem like a lot, but the company got something extraordinary in return.

In addition to crediting the company for remedial measures following the crashes, the agreement states that “the misconduct was neither pervasive across the organization, nor undertaken by a large number of employees, nor facilitated by senior mismanagement.” I cannot recall an affirmative exculpation like this in any other corporate criminal settlement — nor could Brandon Garrett, a law professor at Duke University and one of the country’s foremost experts in the area, who told me that he could “not recall ever seeing language of this sort.”

The typical failure to identify culpable executives in the course of a corporate criminal investigation is usually not for lack of trying. The government often will try to work its way up the managerial ladder when it identifies criminal misconduct at a company, but its ability to do so is significantly hampered by limited resources. As a result, what usually happens is that the government tries — and fails — to identify more senior involvement in the misconduct, and then remains silent on the matter in public documents. One reason is that it is virtually impossible to prove a negative — that no one higher up in the organization was culpable — and every responsible prosecutor knows this. Another is that any kind of affirmative statement to benefit the corporation could have unfair spillover effects by making it harder for private litigants to pursue their own legal cases against the company. (The Justice Department generally does not publicly exonerate anyone.)

So not only is the Justice Department’s exculpation of senior Boeing management unusual, it may prove very problematic for the ongoing lawsuits by victims’ families and shareholders of Boeing who have sued the company on the theory that senior executives did not adequately manage the development of the 737 Max or the resulting fallout from the crashes. It may be significantly harder for victims’ families to obtain punitive damages now, and likewise, the shareholders’ claims may be worth a lot less now, too. When I asked some of the plaintiffs’ lawyers about this prospect, they told me that the Justice Department’s conclusions do not bind them — and technically, they do not — and that they hope to develop a fuller record than the Justice Department did through discovery, using a more aggressive investigative posture. But there is palpable anxiety on this point and understandable frustration with the department, whose deal, for this reason and others, has been widely panned by pretty much every knowledgeable observer, particularly those familiar with the Senate Democrats’ scathing report on the company’s development of the plane and behavior after the crashes.

It is virtually inconceivable that the government investigated the company so thoroughly that it could fully exonerate “senior management” — a phrase that the agreement does not even bother to define. More likely, the company lobbied for inclusion of this provision after providing reams of information to the government about its own internal investigation — an inherently conflicted arrangement that is now par for the course when large companies come under criminal investigation. John Coffee, a professor at Columbia Law School, recently published an excellent book on the long-term failure of corporate criminal enforcement, describing this status quo, in which the government delegates its investigation to a law firm chosen by the defendants, as “probably the greatest failure of current institutional arrangements.” The companies review a lot of documents and conduct a bunch of employee interviews, but Coffee argues that the “predictable” result is that the output “tends to implicate only lower-level executives.”

Virtually every big law firm in New York City and Washington, D.C., now has a large group of lawyers, including many former prosecutors, whose work mainly consists of conducting these sorts of internal investigations for major companies, while simultaneously defending those companies against far less well-resourced government investigations. In this case, Boeing hired a team of lawyers led by Mark Filip, a former senior Bush Justice Department official who had a significant hand in developing the department’s current guidelines on corporate settlements; members of that team declined to answer questions from me about their representation.

At best, the Boeing deal makes no sense, but when you cut through it all, the gist of it seems to be that the company paid $234.6 million of shareholder money to secure an exculpation of its senior management, which may be far more valuable to the company in the long run. Because this deal was completed under Trump officials, it is hard to say how much of this reflects industry-friendly ideological predispositions or ineptitude. I do not hold the people who were running the place until recently in particularly high regard — a group that included a cadre of young white men whose ambition and job responsibilities often exceeded their skill sets — but my guess is that the basic problems with the deal were apparent even to them.

Of course, the public has justifiably been unhappy about the Justice Department’s track record on corporate crime for decades. There are reasons for the long-term increase in financial fraud that transcend any particular administration, and during the Obama presidency, the public bristled at the dearth of criminal convictions for high-level corporate executives in the wake of the financial crisis.

Still, several things seem clear to me: Boeing should have paid substantially more money to settle the investigation; the government should not have been party to an agreement that appears to have been designed to mislead the public into thinking that the company is paying far more money than it actually is; and the exculpation of senior management should never have been included. In isolation, these items may seem unremarkable, but as a package, the deal is a triumph for Boeing and its executives without precedent.

The Boeing deal is perhaps the most glaring evidence from the Trump years that the department’s long-term approach to corporate crime is in desperate need of serious rethinking under Merrick Garland if he is confirmed as Joe Biden’s attorney general. A good start would be a massive increase in the resources that the government devotes to these cases. But commentators such as John Coffee and others have proposed more novel approaches, such as creating a so-called “equity fine” that would require companies to issue new stock if they do not fully cooperate with government investigations. The theory is that the resulting dilution of the company’s stock would particularly affect senior managers (because much of their compensation consists of stock) and, in turn, incentivize innocent executives to turn on culpable executives. To date, we have heard little from the new administration about any plans in this area, but that will hopefully change in the weeks and months ahead. The country’s considerable difficulties with financial fraud, corporate malfeasance, and elite impunity have been decades in the making, and they are not going to end because Trump is gone.

"case" - Google News

January 24, 2021

https://ift.tt/3qJ4goo

The Trump Administration Let Boeing Settle a Killer Case for Almost Nothing - New York Magazine

"case" - Google News

https://ift.tt/37dicO5

https://ift.tt/2VTi5Ee

Bagikan Berita Ini

0 Response to "The Trump Administration Let Boeing Settle a Killer Case for Almost Nothing - New York Magazine"

Post a Comment